Pakistan’s federal budget for the fiscal year 2024-25, presented by Finance Minister Muhammad Aurangzeb on june 12, 2024, with a total outlay of Rs 18.9 trillion, aimed at stabilizing the economy, boosting growth, and securing an IMF bailout. This budget sets important priorities for social welfare, and fiscal management.

Below are the 10 major highlights from the budget, explained clearly to help understand what these changes mean, why they matter, and who they affect.

1. FBR Revenue Target Set at Rs 12.97 Trillion

The Federal Board of Revenue (FBR) has set an unprecedented tax collection target of Rs 12.97 trillion for FY 2024-25, marking a 40% increase from the previous year.

Higher Income Tax Rates (Including Low Incomes)

Salaried individuals face higher taxes. Annual income up to PKR 600,000 is tax-exempt. PKR 600,001–1.2M taxed at 5%. 1.2M–2.2M at 15%, 2.2M–3.2M at 25%, above 10M with an extra 10% surcharge. The hike targets PKR 13T in revenue to narrow the fiscal deficit (The Express Tribune)

Sales Tax on Tier-1 Retailers

Tier-1 retailers must integrate POS systems with FBR by May 31, 2024, or face 60% input tax claim cuts. Sales tax rate also raised from 15% to 18%, and GST exemption was removed for FATA/PATA regions (Sales Tax on Tier-1).

Why does it matter?

This aims to widen the tax net, increase taxes on non-filers, and implement strict enforcement measures. These steps are also crucial for securing the IMF bailout package and ensuring fiscal sustainability.

But the government is putting too much pressure on those who are already paying taxes, like salaried workers and small businesses. At the same time, big sectors like agriculture and real estate still don’t pay their fair share, even though they earn a lot and could help the economy (Dawn).

Who does it affect?

The higher taxes will mostly hit salaried workers, shopkeepers, and middle-income families, who are already struggling with rising costs. Meanwhile, tax evasion continues in powerful sectors that often escape proper reporting.

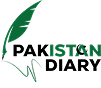

2. Salaries and Pensions Raised for Government Employees

To counter the impact of rising inflation, the Pakistani government announced increases in salaries and pensions in the Federal Budget 2024–25:

- 25% salary increase for government employees in Grades 1–16.

- 20% salary increase for officers in Grades 17–22.

- 15% pension increase for retired government employees.

source : ARY News

Why does it matter?

With inflation at about 12%, these pay and pension increases are meant to help people afford their daily needs. But at the same time, these raises could make it harder for the government to manage its budget and keep the economy stable.

Who does it affect?

These raises will provide much-needed support to employees and pensioners, helping them cope with rising living costs. However, concerns remain about whether the government can sustain these increases, given that Pakistan faces a massive Rs9.8 trillion in debt servicing payments, which puts a heavy strain on the country’s finances.

3. Benazir Income Support Programme (BISP) Expansion

BISP funding increases by 27% to Rs 592 billion, reflecting a stronger focus on social safety nets. Additional funds have been allocated for:

- Utility Stores subsidies amounting to Rs 65 billion to help keep basic goods affordable.

- A Rs 10 billion Ramzan relief package aimed at providing extra support during the holy month.

Source: Business Record

Why does it matter?

With food prices soaring by more than 38% last year, many families are struggling to put basic meals on the table. Expanding social safety nets like BISP and Utility Store subsidies is a vital lifeline that helps ease this burden and keeps millions from falling deeper into poverty.

Who does it affect?

Low-income families, especially those in rural areas, are the primary beneficiaries of these programs. However, critics point out ongoing challenges with efficient implementation and management, which could limit the full impact of these important relief efforts.

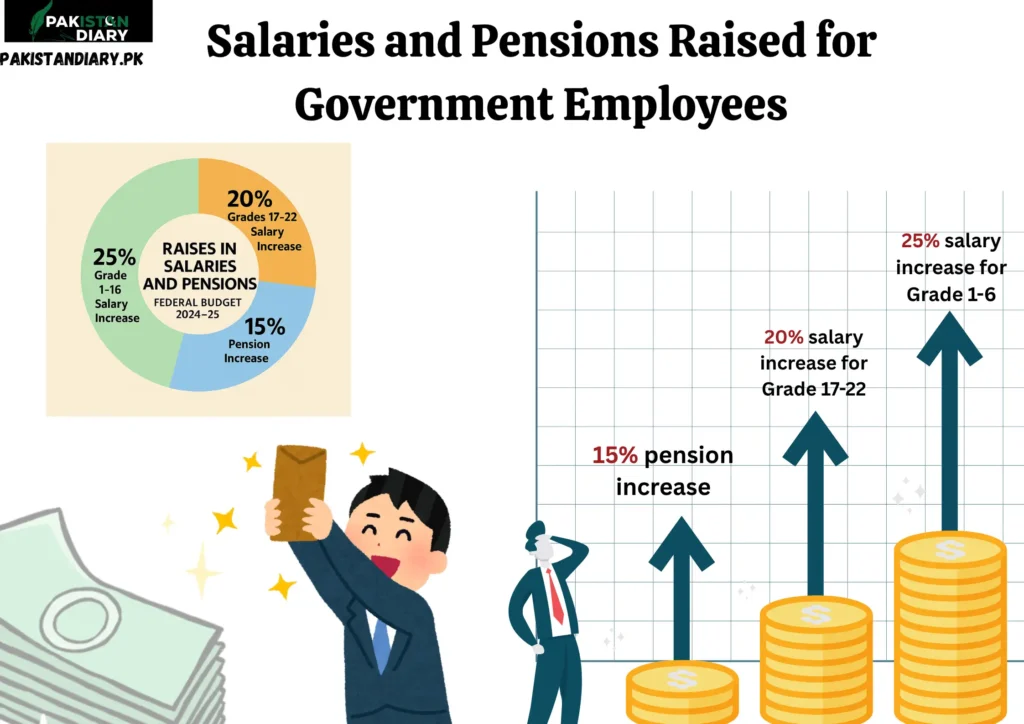

4. Defence Budget Hits Record Rs 2.122 Trillion

Defense spending went up by 17.6% and now makes up 12.3% of the government’s current expenses.

Here’s how the budget is divided among the three forces:

The shares for the Army, Air Force, Navy, and inter-services organizations have stayed pretty steady since 2019.

The Army gets 47.5%, the Pakistan Air Force 21.3%, the Navy 10.8%, and inter-services organizations 20.3% of the total.

Importantly, Rs 662 billion, set aside for retired military personnel, which is about 31% of the total armed forces allocation, won’t come out of the defense budget but will be paid from the government’s regular spending.

source : Dawn News

Why does it matter?

This big increase shows growing worries about security and the government’s focus on boosting the country’s defense, but it also means less money is left for development projects.

Who does it affect?

National security officials see this as necessary, but many economists believe more focus should be placed on shifting funds toward social sectors like health and education to support long-term growth.

5. Fiscal Deficit Target: 5.9% of GDP

The government aims to reduce the fiscal deficit to 5.9% of GDP, down from 7.4% in the previous year.

To achieve this, the budget includes significant tax increases, such as a 40% rise in tax revenue targets, with direct taxes up by 48% and indirect taxes by 35%.

Source: reuters

Why does it matter?

This cut in the deficit is meant to show the government is serious about managing its finances, a key step to unlock a new $6–8 billion loan from the IMF. But meeting this target won’t be easy. It depends on whether the government can actually collect the higher taxes it has planned and keep a tight check on spending.

Who does it affect?

If things go wrong across the economy, it could lead to a sharp rise in prices or cause the rupee to lose value, both of which would hurt everyday people the most.

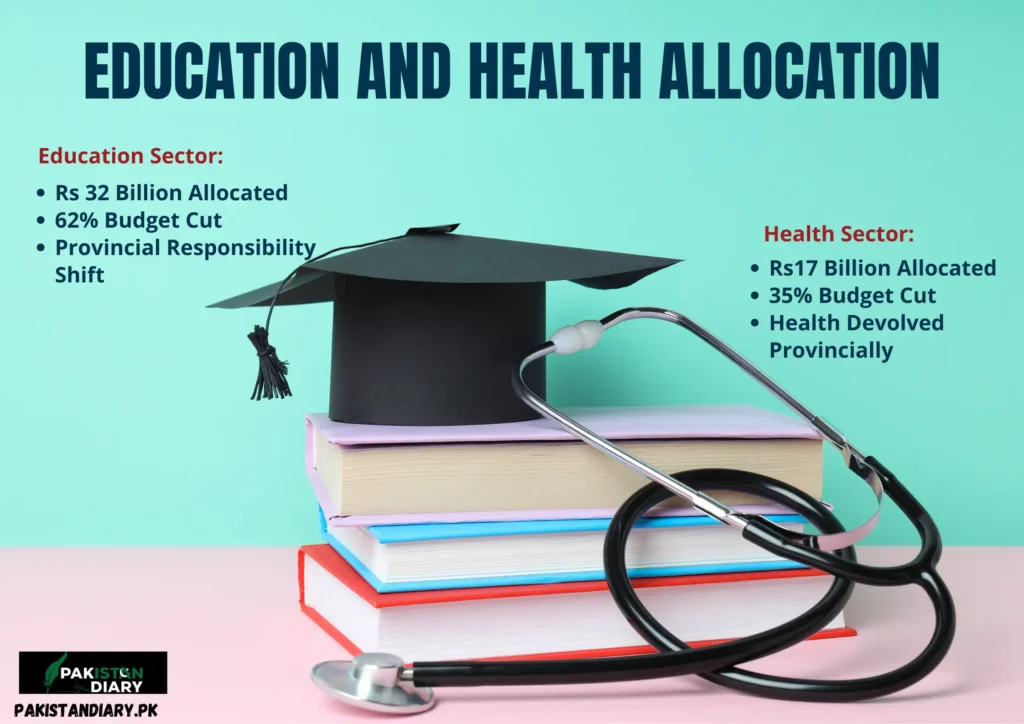

6. Education and Health Allocation

Health Sector:

- The federal government has allocated Rs 17 billion to the health sector for the fiscal year 2024–25.

- This represents a 35% reduction compared to the previous year’s allocation.

- The decrease is attributed to the devolution of health responsibilities to provincial governments.

source : Dawn News

Education Sector:

- The federal allocation for education, including higher education, stands at Rs 32 billion for 2024–25.

- This marks a significant decrease of approximately 62% from the previous year’s allocation of Rs 83 billion.

- The reduction aligns with the ongoing transfer of education-related responsibilities to provincial authorities.

Source: Dawn News

Why does it matter?

Pakistan continues to fall behind neighboring countries when it comes to investing in its people, especially in education and health. Without serious attention to these areas, the country risks long-term setbacks in productivity, innovation, and overall economic growth.

Who does it affect?

Millions of students in public schools and patients relying on government hospitals, especially those from low-income families are directly impacted. When funding is limited, the quality of education and healthcare they receive often suffers.

7. Energy Sector Receives Rs 235 Billion

Rs 235 billion allocated for energy projects, including coal power (1,200 MW in Jamshoro) and renewables, targeting improvements in power generation and distribution.

The government plans to invest big in electricity, using both coal and cleaner energy. This move is meant to reduce load-shedding and make power supply more reliable across the country.

Source: Samaa Tv

Why does it matter?

The goal is to fix Pakistan’s long-running circular debt crisis in the power sector. But raising fuel prices and electricity costs could hit everyday consumers hard , especially those already struggling with rising inflation.

Who does it affect?

Ordinary citizens will feel the pinch through higher fuel and electricity bills, especially low- and middle-income households. However, industries may benefit if the energy supply becomes more stable, potentially boosting production and reducing outages.

8. Public Sector Development programme (PSDP) Set at Rs 1.4 Trillion

The PSDP has been allocated Rs 1.4 trillion.

Focus areas:

- Infrastructure development including roads and dams

- IT parks: Rs 8 billion for Karachi, Rs 11 billion for Islamabad — to boost tech sector and create jobs

Source: The Arabian Stories, ARY News

Why does it matter?

This investment aims to boost economic activity, reduce regional inequalities, and support infrastructure-led growth. The government targets a 3.6% GDP increase, but past delays and under-utilization of PSDP funds raise concerns about actual impact.

Who does it affect?

This plan benefits construction companies working on infrastructure projects, IT startups growing in new tech parks, and job seekers who may find new employment opportunities as these projects progress.

9. Minimum Wage Set at Rs 37,000

- The minimum wage is proposed to increase to Rs 37,000 per month, up from Rs 32,000 previously.

- This raise is designed to keep pace with the expected 12% inflation rate.

Source: Dawn News

Why does it matter?

Raising the minimum wage supports low-income workers by helping them keep up with rising living costs. However, enforcing this increase in informal and small businesses remains a challenge. The goal is to improve the lives of workers and reduce income gaps.

Who does it affect?

Mainly private sector laborers benefit, but many workers in informal small businesses might still miss out due to enforcement issues.

10. Tax Reforms and New Measures Introduced

The budget introduces several tax reforms, including the removal of GST exemptions in FATA/PATA regions and increased sales tax rates for certain retailers.

Why does it matter?

The budget also introduces a new category called Late Filers to encourage taxpayers to submit their returns on time, aiming to improve overall tax compliance and reduce delays.

Who does it affect?

These measures impact businesses and consumers in the affected regions, aiming to enhance revenue collection and fiscal discipline.

Experts OPinion:

The representative body for the sector, All Pakistan Textile Mills Association, called for a review of the budget, terming it “extremely regressive” and one that “threatens the collapse of the textile sector and its exports” (reuters).

Miftah Ismail (Former Finance Minister)

Miftah Ismail criticized the budget as a missed opportunity, expressing disappointment over the government’s constrained approach. He pointed out that while the budget aimed to increase tax revenues, it continued to rely heavily on indirect taxes, which disproportionately affect lower-income groups. Ismail also highlighted the challenges posed by the taxation of exporters and the potential negative impact on the economy (Dawn).

Sana Tawfiq (Economist and Analyst)

Sana Tawfiq acknowledged the ambitious revenue target set at Rs 12.97 trillion but expressed concerns about its feasibility. She noted that the government’s focus on increasing taxes on previously untaxed sectors might strain the economy. Tawfiq also highlighted the significant increase in expenditures, raising questions about the government’s commitment to fiscal consolidation (Geo News).

Conclusion

Pakistan’s Budget 2024–25 is trying to find a middle ground. It focuses on meeting IMF requirements and reducing the budget gap, while also trying to help people through social programs and improve roads, schools, and hospitals. Although this shows some positive steps for the economy, important changes in taxes, energy, and government management still need to be done. The budget puts more pressure on salaried workers and businesses, but the extra support for social services and development gives hope for a better future.